“All our dreams can come true, if we have the courage to pursue them.”- Walt Disney

The typical financial advice focuses on helping people determine what they need for their lives financially.

For instance you might be thinking….

How much do I need to save?

How much money do I need to accumulate for my future?

How much income do I need to live on in retirement?

How much insurance do I really need?

No wonder most people would rather do a hundred other things than talk about their personal finances.

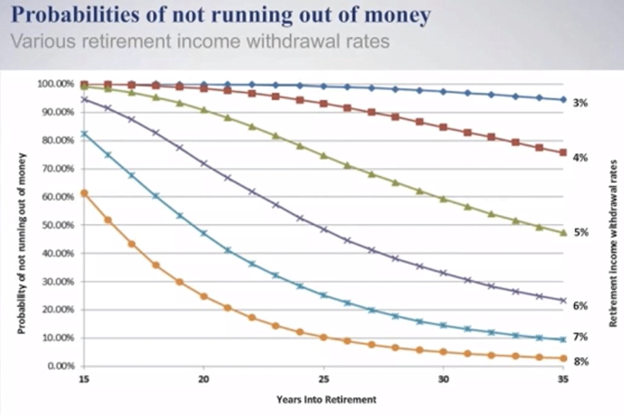

Take an example you may have heard before. You’ve been diligently saving in your 401k plan throughout your life to amass a $1MM nest egg you need to turn into income in retirement. Based on the running Monte Carlo simulations on market performance, it has been determined that a 4% withdrawal rate would be safe to minimize the chance of running out of money (see below chart).

Now, even at 4%, there is still chance of running out. That’s only $40k/year before taxes off of a $1MM asset. Probably not the retirement you were envisioning, and we haven’t even factored in the tax risk for the future. It may satisfy your basic needs, but it’s probably not going to allow you to do the things you want.

So, what if you could enjoy more of your income that you’ve worked so hard to accumulate AND pass on more to future generations?

What if you could withdrawal twice as much or more from this account safely by deploying different strategies? What would you want to do with the additional wealth and income for your families or communities?

It can be done by taking a deeper look at your current strategies and determining what it is in life you truly want. You don’t have to settle on what you need; you can get what you want in life!